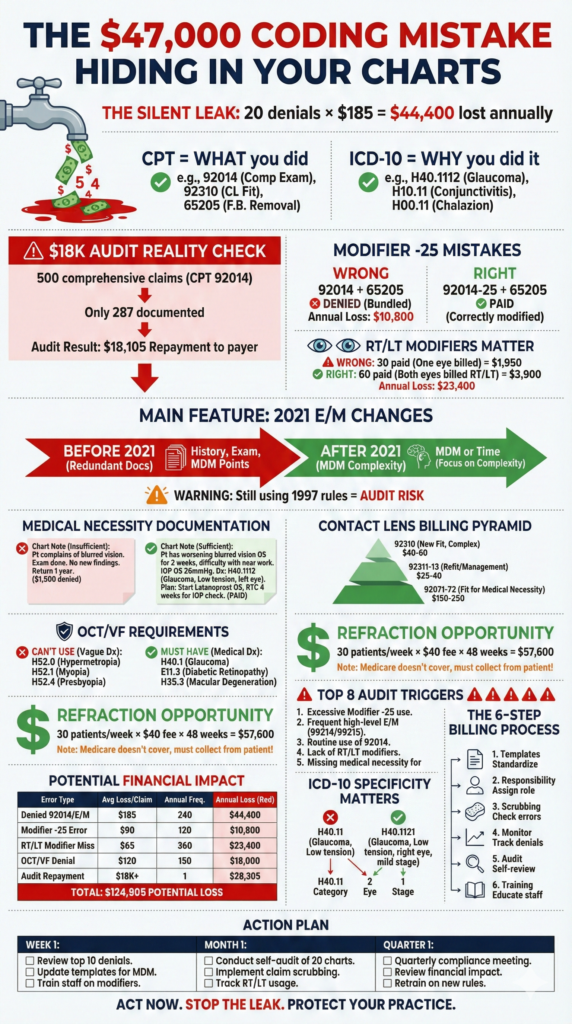

Optometry Billing and Coding: The $47,000 Mistake Hiding in Your Charts

Your front desk just submitted 40 claims. Twenty of them will get denied. Not because the exams weren’t performed. Not because the services weren’t valuable. But because someone wrote “92014” when it should have been “92012-25-RT.”

That tiny error? It just cost you $185. Multiply by twenty denials monthly, and you’re leaving $44,400 on the table every year. And that’s before we talk about the audit risk.

Optometry billing and coding isn’t just administrative paperwork—it’s the difference between getting paid properly and funding your competitors’ vacations with money that should be yours.

Key Insights

- 92004 vs 92014: Wrong code selection triggers automatic audits—comprehensive requires COMPREHENSIVE documentation

- Modifier -25 is non-negotiable: Missing this on same-day exam + procedure = bundled services = denied claim

- RT/LT modifiers are mandatory for bilateral procedures—missing them costs 50% reimbursement

- 2021 E/M coding rules changed everything: Most optometrists still use outdated 1997 guidelines (massive audit risk)

- Medical necessity must be documented: “Annual exam” won’t cut it—specific symptoms/conditions required

- OCT codes (92132-92134) require separate medical diagnosis—can’t bill with routine vision codes

- Contact lens codes differ by complexity: 92310 (basic) vs 92071 (complex fitting)—wrong one = denial

- ICD-10 specificity is crucial: “H52.4” (presbyopia) accepted, “refractive error” rejected

The Two-Code System That Confuses Everyone

Every optometry service needs two codes to get paid:

CPT codes tell insurance what you did. Comprehensive exam? 92014. Visual field test? 92083. Refraction? 92015.

ICD-10 codes tell insurance why you did it. Diabetes with retinopathy? E11.359. Glaucoma suspect? H40.009. Annual preventive? Z01.00.

Here’s where practices mess up: they pick CPT codes based on what’s convenient rather than what’s documented. And they pick ICD-10 codes based on what sounds close enough rather than specific diagnoses.

Insurance companies have algorithms that flag mismatches instantly. “Comprehensive exam but only documented 3 elements? Flag for audit.” “Billed medical code but diagnosis says routine? Deny.”

The Comprehensive vs. Intermediate Trap

92004 (new patient) and 92014 (established patient) are comprehensive exam codes. They pay well—typically $85-$120 depending on payer. So naturally, everyone bills them.

Problem: “Comprehensive” has a definition. It means you documented:

Chief complaint and history of present illness Review of systems Past, family, social history Complete visual examination (acuity, refraction, ocular motility, confrontation fields, biomicroscopy, dilated fundus exam, tonometry) Assessment and plan

If your chart says “Patient here for annual exam. Refraction performed. Eyes healthy. Return in 1 year,” that’s not comprehensive. That’s barely intermediate.

The correct codes:

- 92002/92012: Intermediate exams (limited scope, straightforward cases)

- 92004/92014: Comprehensive exams (extensive documentation, complex evaluation)

One practice got audited on 500 comprehensive claims. Auditor found adequate documentation for 287 claims. Demanded repayment on 213 claims = $18,105 plus penalties. Their crime? Billing comprehensive for everyone automatically regardless of documentation.

They implemented structured exam templates ensuring proper documentation. Denied claims dropped from 42% to 7%. Recovered $36,000 in previously lost revenue annually.

7-day free trial

Got Any Questions? Let us know in the Contact Us form below.

Modifier -25: The $185 You’re Probably Losing

You perform a comprehensive exam. During that exam, you remove a foreign body from the patient’s eye. You bill 92014 and 65205 (foreign body removal).

Without modifier -25 on the exam code, the claim gets denied. Why? Insurance thinks the exam is “included” in the procedure—standard pre-procedure assessment.

Modifier -25 says: “No, this was a significant, separately identifiable evaluation above and beyond the procedure.” It tells insurance to pay both codes.

When to use -25:

- Comprehensive exam + same-day procedure (chalazion removal, foreign body, pterygium excision)

- Evaluation AND management of unrelated condition same day as procedure

- Significant exam findings requiring intervention during scheduled procedure visit

When NOT to use -25:

- Brief assessment before minor procedure (that’s included)

- Quick recheck after procedure (part of global period)

- Routine post-op visit

Most practices forget -25 entirely. Result: 50% reimbursement loss on those appointments. If you’re performing even 5 procedures monthly, that’s $900 lost monthly = $10,800 annually.

“I see practices that know their CPT codes cold but forget modifiers entirely. It’s like knowing the words but forgetting punctuation—the meaning changes completely. Modifier -25 alone probably accounts for $8,000-$15,000 in lost annual revenue for typical practices. RT and LT modifiers? Another $5,000-$10,000. The codes matter, but the modifiers are where money actually vanishes.”

— Adam Smith, Product Manager @ Glasson

The RT/LT Modifier Requirement Nobody Follows

Any bilateral procedure—meaning you perform it on both eyes—requires laterality modifiers:

RT: Right eye LT: Left eye

Examples that require RT/LT:

- Visual field testing (92083-RT, 92083-LT)

- OCT imaging (92134-RT, 92134-LT)

- Contact lens fitting (92310-RT, 92310-LT if fitting both eyes)

- Eyelid procedures (67840-RT for right upper lid)

What happens without them?

You bill 92083 twice (visual fields both eyes). Insurance sees duplicate billing. Pays once, denies the second. You just lost 50% reimbursement on that service.

You bill 92134 for OCT without RT/LT. Insurance doesn’t know if you imaged one eye or both. Pays for one by default. If you actually imaged both eyes, you lost 50%.

Financial impact example:

- 30 bilateral visual field tests monthly

- Payment per test: $65

- Proper billing: 60 claims (30 × 2 eyes) = $3,900

- Without RT/LT: 30 paid + 30 denied = $1,950

- Monthly loss: $1,950 | Annual loss: $23,400

Modern practice management systems can enforce modifier requirements at billing stage, preventing submission without proper laterality.

Medical Necessity: The Defense Against Audits

Every service billed to medical insurance needs medical necessity—documented clinical reason justifying the service.

What medical necessity looks like:

❌ Insufficient: “Patient here for annual eye exam” ✅ Sufficient: “Patient with family history of glaucoma (father diagnosed age 52) presents for evaluation. Reports occasional halos around lights at night. IOP screening and optic nerve assessment medically necessary.”

❌ Insufficient: “Performed OCT” ✅ Sufficient: “OCT performed to evaluate optic nerve cupping asymmetry noted on dilated exam. Right disc C/D 0.6, Left disc C/D 0.4. Rule out glaucomatous changes.”

Key principle: Document why this service was medically necessary for this patient on this date. Generic templates won’t cut it during audits.

Medical necessity checklist:

- Patient symptoms documented

- Clinical findings documented

- Risk factors noted

- Reason for testing/service explained

- Results interpreted

- Impact on treatment plan documented

One practice received pre-payment review request on 20 OCT claims. They documented findings but not medical necessity. All 20 denied = $1,500 lost. They revised documentation templates to require medical necessity statement before claim submission. Next audit: 19 of 20 approved.

Want to see Glasson's full potential?

Book a presentation

The 2021 E/M Coding Rules You’re Probably Ignoring

In 2021, the American Medical Association completely overhauled E/M coding—the 99000 series codes used for medical visits.

Old rules (pre-2021): Code level based on documented history, exam, and medical decision-making elements. Needed extensive documentation to justify high-level codes.

New rules (2021+): Code level based on Medical Decision Making (MDM) complexity OR time spent.

What changed:

You no longer need to document 10+ review of systems and exhaustive past medical history to bill 99214. You need to document complex medical decision-making.

MDM complexity factors:

- Number and severity of problems addressed

- Amount of data reviewed (prior records, test results, imaging)

- Risk of complications or morbidity without treatment

Example of 99214 (moderate MDM) under new rules:

“Patient with known POAG on latanoprost presents with IOP increase from 14 to 22 mmHg despite compliance. Reviewed prior 3 visits showing progressive IOP elevation. Ordered visual field and OCT to assess progression. Discussed treatment modification options including adjunctive therapy vs. laser trabeculoplasty. Explained risks/benefits. Patient prefers trial of adjunctive drop. Started dorzolamide BID. Follow-up in 6 weeks for pressure check.”

That documentation supports 99214 under 2021 rules. Under old rules, you’d need detailed ROS, social history, and 8 body systems examined.

Why this matters: Many practices still use 1997 templates with excessive, irrelevant documentation. This wastes clinician time AND increases audit risk (“note bloating”). Updating to 2021-compliant documentation standards saves time and improves defensibility.

Contact Lens Coding: Four Different Ways to Get It Wrong

Contact lens services have multiple billing options depending on what you’re actually providing:

92310: Contact lens fitting, initial (basic)

- For standard soft contact lenses

- Straightforward prescriptions

- No significant complications

- Lower reimbursement

92311-92313: Contact lens fitting follow-ups

- Subsequent visits related to original fitting

- Problem-solving during adaptation

- Adjustments or replacements

92071-92072: Complex contact lens fitting

- Keratoconus, irregular corneas, post-surgical fitting

- Specialty lenses (scleral, hybrid, custom)

- Significantly higher reimbursement than basic fitting

- Requires documented medical necessity

Common error #1: Billing 92310 for keratoconus patient fitted with specialty sclerals. Undercoding by $150-$200.

Common error #2: Billing 92071 without medical necessity diagnosis. Automatic denial.

Common error #3: Not billing follow-up visits (92311-92313) at all. Leaving money on table.

Common error #4: Billing contact lens codes with routine vision diagnosis. Medical contact lens codes require medical diagnosis (keratoconus H18.60, irregular astigmatism H52.21, aphakia H27.0).

The fix: Create clear protocols for when to use each code series. Document medical necessity for complex fittings. Bill follow-ups appropriately. Track which services are being provided and ensure proper coding.

OCT and Visual Field Testing: Separate but Related

OCT codes (92132-92134) and Visual field codes (92081-92083) are high-value diagnostic tests. They’re also heavily scrutinized.

OCT (Optical Coherence Tomography):

- 92132: Optic nerve analysis

- 92133: Retinal analysis

- 92134: Both optic nerve and retinal analysis

Key requirement: Medical diagnosis required. Can’t bill OCT with routine refractive error or annual exam. Need glaucoma suspect, diabetic retinopathy, macular degeneration, optic nerve disease, etc.

Visual Field Testing:

- 92081: Basic visual field exam (confrontation)

- 92082: Intermediate visual field (typically automated)

- 92083: Extended visual field (threshold testing)

Key requirement: Medical necessity documented. Why does this patient need VF testing today?

Common billing errors:

❌ Billing 92134 + 92083 on every patient “just because” ❌ No medical necessity documented ❌ Same codes billed every visit without documenting change or progression ❌ Billing to routine vision insurance (won’t pay)

Correct approach:

✅ Document clinical findings requiring testing ✅ Bill to medical insurance with medical diagnosis ✅ Interpret results and document findings ✅ Explain how results impact treatment plan ✅ Use automated claim scrubbing to catch missing medical diagnoses before submission

Test Glasson for 7 days free of charge

Any questions? Leave your contact details and we'll call you back.

Refraction: The Service Everyone Performs But Half Bill Wrong

CPT 92015: Refraction

This is determination of refractive error—finding the glasses/contact lens prescription.

Key facts:

- Medicare does not cover refraction

- Must be billed as patient responsibility

- Requires Advance Beneficiary Notice (ABN) for Medicare patients

- Can be billed to vision insurance

- Often billed alongside exam codes (92014 + 92015)

Common errors:

Error #1: Billing refraction to Medicare without ABN. Denied, can’t collect from patient.

Error #2: Not billing refraction at all. Lost revenue.

Error #3: Bundling refraction into exam instead of billing separately to vision insurance. Lost additional revenue.

The financial impact:

You see 200 patients monthly. 60% have vision insurance that covers refraction separately. That’s 120 patients × $40 average = $4,800 monthly or $57,600 annually in potential revenue.

If you’re not billing 92015 to vision insurance separately (or collecting from patients when not covered), you’re leaving tens of thousands on the table.

Common Coding Errors That Trigger Audits

1. Billing comprehensive exams without comprehensive documentation Autopilot billing 92014 for everyone regardless of actual exam scope.

2. Missing modifiers Especially -25 (separate E/M), RT/LT (laterality), and -55 (post-op care).

3. Incorrect diagnosis codes Using outdated codes, insufficient specificity, or mismatched diagnoses.

4. Unbundling services Billing components separately that should be bundled.

5. Upcoding Selecting higher-level codes than documentation supports.

6. Medical vs. routine confusion Billing medical codes with routine diagnoses or vice versa.

7. Lack of medical necessity Performing services without documented clinical justification.

8. Duplicate billing Submitting same service twice without proper modifiers.

The audit process:

Insurance requests medical records for 20 claims. You submit. They review documentation line by line. Any code not fully supported = repayment demanded + potential penalties.

Protect against audits:

- Implement internal auditing quarterly

- Review random sample of charts for coding accuracy

- Ensure documentation supports codes billed

- Train staff on proper coding annually

- Use templates that enforce documentation requirements

- Generate regular reports on coding patterns to identify outliers

[banner_blog_4]

Building Your Coding Process

Step 1: Standardize documentation templates

Create templates for each exam type with required elements pre-populated. Ensures nothing gets missed.

Step 2: Assign coding responsibility

The doctor should make final coding decisions—it’s their license. Billing staff can recommend codes based on documentation, but doctor reviews and approves.

Step 3: Implement pre-submission scrubbing

Automated claim scrubbing catches errors before submission: missing modifiers, diagnosis/procedure mismatches, invalid code combinations.

Step 4: Monitor denial patterns

Track why claims get denied. If “missing medical necessity” appears repeatedly, fix documentation templates. If modifier errors dominate, implement training.

Step 5: Quarterly internal audits

Review random sample of 20 charts monthly. Score documentation quality. Identify improvement areas. Provide feedback to clinicians.

Step 6: Annual coding education

Every January, review CPT code changes with entire team. Update software. Revise templates. Test systems before submitting real claims.

Payer-Specific Rules: The Hidden Complexity

Every insurance company has unique policies beyond standard CPT/ICD-10 rules.

Examples:

- Some payers require prior authorization for OCT

- Some bundle refraction with exam; others pay separately

- Some accept modifier -25 liberally; others scrutinize heavily

- Some require specific diagnosis codes for certain services

Managing payer complexity:

Create payer policy database tracking requirements for top 10 payers (who represent 80% of revenue). Update quarterly.

Document payer guidance: When you call and get clarification, record: date, representative name, reference number, guidance provided.

Appeal unjust denials: If you followed payer rules but got denied anyway, appeal with documentation and policy citation.

Your Action Plan

This week:

- Audit 10 recent charts—does documentation support codes billed?

- Review last month’s denials—identify patterns

- Check if modifiers are being used correctly

This month:

- Implement standardized templates for comprehensive vs. intermediate exams

- Train staff on -25 and RT/LT modifier requirements

- Create payer policy reference guide

This quarter:

- Conduct internal audit of 50 random claims

- Calculate revenue impact of coding improvements

- Update documentation to 2021 E/M standards

Frequently Asked Questions

Q: What’s the difference between 92004 and 92014?

A: 92004 is for new patients (no prior relationship with practice). 92014 is for established patients (seen within past 3 years). Both require comprehensive examination elements. Payment differs slightly—92004 typically pays $5-$15 more. Otherwise, documentation requirements are identical.

Q: Do I always need modifier -25 when doing an exam and procedure same day?

A: Only if the exam is significant and separately identifiable from the procedure. Brief pre-procedure assessment is included. But if you perform comprehensive exam AND discover something requiring immediate procedure, -25 is required on exam code.

Q: Can I bill OCT on every patient to screen for disease?

A: Not to medical insurance. OCT requires medical necessity—documented findings, symptoms, or risk factors justifying testing. Routine screening on asymptomatic patients with no risk factors won’t be covered. Some vision plans cover OCT as additional benefit.

Q: What happens if I use the wrong ICD-10 code?

A: Claim may be denied if diagnosis doesn’t support service. For example, billing 92134 (OCT) with Z01.00 (routine eye exam) will be denied—routine code doesn’t justify medical testing. Correct diagnosis required.

Q: How specific do ICD-10 codes need to be?

A: Very specific. “Glaucoma” isn’t a valid code. Need: type (primary open-angle, angle-closure, etc.), stage (mild, moderate, severe), and laterality (right, left, bilateral). H40.1121 = primary open-angle glaucoma, mild stage, right eye.

Q: Should I bill medical insurance or vision insurance?

A: Depends on chief complaint and diagnoses. Medical symptoms/conditions → medical insurance. Routine refractive exams, eyeglasses, basic contact lenses → vision insurance. Many patients have both—coordinate benefits appropriately. Patient records should track both.

Q: What if my documentation doesn’t support comprehensive codes?

A: Bill intermediate codes (92002/92012) honestly. It’s better to get paid less than face audit repayment demands later. Then improve documentation going forward so you CAN support comprehensive when appropriate.

Q: Can I bill 92014 and 99214 on the same day?

A: Generally no—one or the other, not both. 92014 is for eye examination. 99214 is for medical evaluation/management. Choose based on primary focus of visit. Exception: If truly addressing two completely separate problems with distinct documentation, possible with modifier -25, but rare.

Q: How often should I perform internal coding audits?

A: Quarterly minimum for random sample (20 charts). Annually for comprehensive review (100+ charts). Monthly review of denial patterns. Continuous monitoring of coding metrics. Regular audits prevent problems before external auditors find them.

Q: Is coding software worth the investment?

A: Absolutely. Modern systems offer: real-time eligibility verification, automated claim scrubbing, proper modifier enforcement, payer-specific rules integration, denial tracking, and coding analytics. ROI typically 3-6 months through reduced denials and faster reimbursement.

English

English  Polski

Polski  Čeština

Čeština  Deutsch

Deutsch  Español

Español  Français

Français  Ελληνικά

Ελληνικά  Hrvatski

Hrvatski  Italiano

Italiano  Lietuviškai

Lietuviškai  Magyar

Magyar  Nederlands

Nederlands  Português

Português  Română

Română  Slovenčina

Slovenčina  Svenska

Svenska  Türkçe

Türkçe  Русский

Русский