Your Optometry Practice Business Plan: The Blueprint That Actually Works

Remember that business plan you wrote for school? The one that got an A+ and then immediately became digital clutter on your hard drive? Yeah, your optometry practice deserves better than that.

Starting or expanding an eye care practice without a solid business plan is like performing an exam without a phoropter—you might get somewhere, but it’s going to be messy, inefficient, and probably expensive.

This isn’t about impressing investors with fancy charts. This is about creating a document that helps you make real decisions when you’re staring at a $150,000 equipment invoice or deciding whether to hire that third optician.

Key Insights

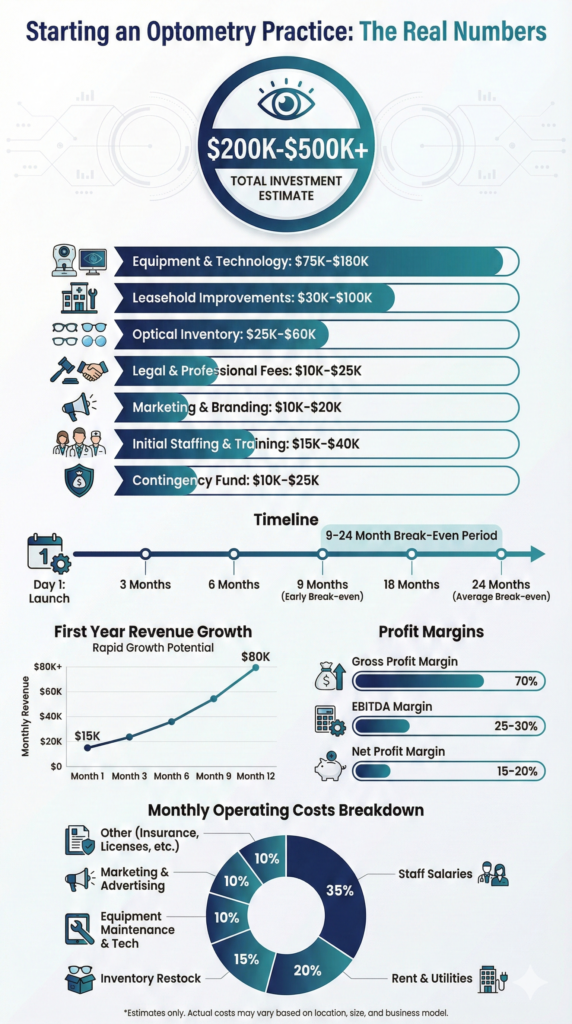

- The real cost: Opening a full-service optometry clinic requires $200,000 to $500,000+ in startup capital—before you see your first patient

- Profit reality: Small independent clinics typically achieve 10-20% net profit margins, while practices with optical shops can reach 25-30% (established practices hit 28-40%)

- Break-even timeline: Expect 9-12 months for specialty focus practices, or 18-24 months for full-service operations

- Staff costs dominate: Payroll represents your largest ongoing expense at $15,000-$25,000+ monthly for a small practice

- Marketing investment: Allocate 5-10% of revenue—it’s not optional anymore

- Patient lifetime value: Your LTV:CAC ratio should be minimum 3:1 (patient value should be three times acquisition cost)

Why Your Business Plan Matters More Than You Think

Here’s the truth: 67% of optometry practices don’t track their financial performance systematically. They’re basically flying blind, making gut decisions about equipment purchases and expansion based on “what feels right.”

Your business plan isn’t a formality—it’s your practice’s GPS. It’s the difference between “I think we can afford another optician” and “Based on our 18-month patient growth trajectory and revenue per exam hour, we need another optician by Q3.”

What Makes an Optometry Business Plan Different

You can’t just download a generic healthcare business plan template and fill in the blanks. Optometry has unique characteristics:

Capital intensity upfront: You need serious equipment before day one. That phoropter, slit lamp, autorefractor, and visual field analyzer—you’re looking at $100,000-$250,000+ just for diagnostic equipment.

Dual revenue streams: You’re not just providing services; you’re also retailing products. That means inventory management and gross margins on eyewear (50-70%) that dramatically affect profitability.

Insurance complexity: You’re navigating both vision insurance (VSP, EyeMed) and medical insurance (Medicare, commercial plans) with different reimbursement rates and administrative overhead.

Technology evolution: OCT, corneal topographers, digital retinal imaging—equipment that was cutting-edge five years ago is now table stakes. Your plan needs continuous technology investment.

7-day free trial

Got Any Questions? Let us know in the Contact Us form below.

The Core Components Your Business Plan Needs

Forget the 50-page dissertation. Your optometry practice business plan needs these sections that answer specific questions about your practice’s viability.

Executive Summary: Your Two-Page Pitch

This gets written last but appears first. You’ve got two pages to convince someone (investor, lender, or future you) that your practice makes sense.

Include:

- Your practice’s unique value proposition

- Target patient demographics and market size

- Initial capital requirements and funding sources

- Three-year revenue projections

- Timeline to profitability

- Core services and specialty focus areas

Market Analysis: Understanding Your Opportunity

Ever wonder why two optometry practices five miles apart can have vastly different results? Market analysis makes the difference.

Critical metrics to research:

- Population density: How many potential patients within 5-10 mile radius?

- Optometrist-to-population ratio: Target 1:7,000—better ratios mean less competition

- Age demographics: Aging populations mean more glaucoma, cataracts, macular degeneration

- Income levels: Higher incomes correlate with premium frame sales

- Competitor analysis: How many practices nearby? What’s their specialty? Where are the gaps?

One practice owner in suburban Atlanta noticed five optometry offices, but none offered evening or weekend appointments. She structured her schedule for working professionals—and built a 2,000-patient practice in 18 months.

<expert_voice> “The biggest mistake I see in business plans is practitioners copying financial projections from generic templates without understanding their local market dynamics. A practice in rural Montana has completely different economics than one in downtown San Francisco. Your numbers need to reflect your actual market, not some national average that might be meaningless for your situation.”

— Adam Smith, Product Manager @ Glasson </expert_voice>

Operations Plan: How You’ll Actually Run This

Staffing structure and costs:

| Position | Responsibilities | Salary Range (Annual) |

| Optometrist(s) | Exams, diagnosis, prescriptions | $100,000-$150,000+ |

| Optician(s) | Frame selection, dispensing | $35,000-$55,000 |

| Ophthalmic Technician | Pre-testing, imaging | $30,000-$45,000 |

| Front Desk | Appointments, insurance, checkout | $28,000-$40,000 |

Remember: Payroll is your largest ongoing expense. For a small practice with one optometrist, two opticians, and two administrative staff, you’re looking at $15,000-$25,000 monthly in wages before benefits and taxes.

Technology requirements:

Modern optometry requires integrated practice management software that handles:

- Electronic health records with HIPAA compliance

- Appointment scheduling and reminders

- Insurance verification and claims

- Inventory tracking for optical products

- Patient communication via SMS and email

- Financial reporting and analytics

Budget $10,000-$30,000 for practice management and EHR systems in startup costs.

Marketing Strategy: How You’ll Fill Your Schedule

You could be the best optometrist in the state, but if nobody knows you exist, you’ll be doing excellent exams for an empty waiting room.

Digital marketing foundation:

- Website: Mobile-responsive, fast loading, clear services and booking

- Search engine optimization: Target “optometrist near me” and “eye exam [your city]”

- Google Business Profile: Optimized with photos, reviews, accurate information

- Online booking: Let people schedule appointments 24/7

- Social media: Educational content, frame showcases, patient testimonials

Local marketing tactics:

- Primary care physician partnerships for referrals

- Corporate wellness programs and vision screening

- School vision screening programs (pediatric patient base)

- Community event sponsorships

- Direct mail to new residents

Patient retention strategies:

Acquiring a new patient costs 5-25 times more than retaining an existing one. Your client management system should track annual exam reminders, contact lens reorder reminders, birthday greetings, referral incentives, and treatment follow-ups.

Allocate 5-10% of revenue to marketing. For a practice targeting $500,000 annually, that’s $25,000-$50,000 for patient acquisition.

Financial Plan: The Numbers That Matter

This is where business plans either get really good or completely fall apart. Your financial plan needs detail, realism, and actual industry benchmarks.

Startup cost breakdown:

| Category | Low End | High End |

| Lease & Build-Out | $50,000 | $150,000+ |

| Clinical Equipment | $100,000 | $250,000+ |

| Optical Inventory | $20,000 | $50,000+ |

| Technology & Software | $10,000 | $30,000 |

| Furniture & Fixtures | $15,000 | $40,000 |

| Licensing & Legal | $5,000 | $15,000 |

| Working Capital | $30,000 | $100,000 |

| TOTAL INVESTMENT | $230,000 | $635,000+ |

Want to see Glasson's full potential?

Book a presentation

Revenue projections—being realistic:

Don’t project 30 patients per day from month one. Here’s a realistic ramp:

Year 1: 8-12 patients daily, building to 15-20 by month 12

- Average exam fee: $125-$175

- Optical capture rate: 60-70%

- Average eyewear sale: $350-$500

- Total Year 1 revenue: $180,000-$280,000

Year 2: 18-25 patients daily

- Repeat patients + referrals building momentum

- Total Year 2 revenue: $350,000-$500,000

Year 3: 22-30 patients daily

- Adding specialty services increases average revenue

- Total Year 3 revenue: $500,000-$750,000+

Operating expenses—monthly reality:

| Expense Category | Monthly Cost |

| Payroll (non-doctor) | $15,000-$25,000 |

| Rent & utilities | $4,000-$8,000 |

| Equipment lease/maintenance | $2,000-$4,000 |

| Supplies & materials | $3,000-$6,000 |

| Marketing | $2,000-$5,000 |

| Insurance | $500-$1,500 |

| Technology & software | $1,000-$2,000 |

| Professional services | $1,000-$2,000 |

| Miscellaneous | $1,500-$3,000 |

| TOTAL MONTHLY | $30,000-$56,500 |

This means you need roughly $360,000-$678,000 annual revenue just to break even before doctor compensation.

Break-even timeline:

- 9-12 months: Specialty focus clinics

- 12-18 months: General optometry with optical

- 18-24 months: Full-service medical optometry

The Financial Metrics That Predict Success

Numbers don’t lie—but you need to track the right ones.

Patient Lifetime Value (LTV)

A loyal patient coming for 20 years—annual exams at $150, glasses every two years at $400, progressives at 45, specialty contacts, dry eye treatment—can easily generate $10,000-$20,000 in lifetime revenue.

If you spent $200 acquiring that patient through marketing, that acquisition cost suddenly doesn’t seem expensive.

Calculate your LTV:

- Average annual revenue per patient

- Multiply by average retention period (years)

- Factor in referral value if trackable

Customer Acquisition Cost (CAC)

How much do you spend to get one new patient? Divide total marketing spend by new patient count.

Example: $3,000 on ads and events, 45 new patients acquired = $67 per patient CAC

Compare to LTV: If LTV is $12,000 and CAC is $67, your ratio is 179:1—exceptional. Industry benchmark is minimum 3:1, with high-growth practices achieving 10:1.

If your LTV is $3,000 and CAC is $1,500 (ratio 2:1), you have a problem. Time to either reduce acquisition costs or increase patient value through better inventory management and service offerings.

Revenue Per Exam Hour

How much revenue do you generate per hour examining patients? This reveals efficiency and service mix effectiveness.

A practice doing 20 patients daily at $150 per exam over 160 hours monthly generates $24,000 ÷ 160 = $150 per exam hour. But with 70% optical capture at $400 average, you’re generating closer to $325 per exam hour.

Compare to a practice seeing 30 patients daily with only 30% optical capture—similar or less revenue per exam hour despite higher volume.

Quality beats quantity.

Technology Investment: What You Really Need

Opening an optometry practice means serious capital investment before you see your first patient.

Minimum viable equipment:

- Phoropter: $4,000-$8,000

- Slit lamp: $5,000-$15,000

- Autorefractor: $8,000-$20,000

- Lensometer: $2,000-$5,000

- Tonometer: $3,000-$8,000

- Ophthalmoscope: $1,000-$3,000

- Trial lens set: $2,000-$4,000

- Visual acuity system: $3,000-$8,000

Basic equipment total: $28,000-$71,000

Advanced diagnostic technology:

- OCT: $40,000-$100,000+

- Visual field analyzer: $20,000-$40,000

- Corneal topographer: $15,000-$35,000

- Fundus camera: $15,000-$45,000

Suddenly you’re at $100,000-$250,000+ for a well-equipped modern practice.

Practice management software: why it matters

Your practice management and EHR system connects everything:

- Patient scheduling with automated reminders

- Electronic health records with exam documentation

- Insurance verification and billing

- Inventory management for frames and lenses

- Financial reporting showing profitability

- Patient communication across channels

Budget $10,000-$30,000 for initial setup, plus $500-$1,500 monthly for subscriptions and support.

Consider the alternative: losing thousands in uncollected claims, running out of best-selling frames, never knowing which services actually make money. One solo practitioner found automated appointment reminders reduced no-shows by 45%—an extra $2,400 monthly in completed appointments. The system paid for itself in the first quarter.

Test Glasson for 7 days free of charge

Any questions? Leave your contact details and we'll call you back.

Risk Management: Protect Yourself

Insurance coverage you can’t skip:

Professional liability/malpractice: $500-$4,000+ per provider annually (covers misdiagnosis, prescription errors, treatment complications—without it, you’re one lawsuit away from losing everything)

General liability: $500-$2,000 annually (covers patient injuries, property damage, slip-and-falls)

Property insurance: $1,000-$3,000 annually (covers equipment, inventory, and improvements—$200,000+ in assets needs protection)

Workers’ compensation: Varies by state, typically $2,000-$5,000 annually

Business interruption: $1,000-$3,000 annually (covers lost revenue if you can’t operate due to fire, flood, equipment failure)

Cyber liability: $1,000-$3,000 annually (HIPAA breaches can cost $50,000+ in fines and legal fees)

Total annual insurance budget: $6,000-$20,000+

Plan for the unexpected:

- Cash reserves: Maintain 3-6 months operating expenses in accessible savings

- Equipment maintenance: Budget for repairs and eventual replacement

- Compliance costs: HIPAA, OSHA, ADA requirements have ongoing expenses

- Continuing education: Maintain licenses and stay current with technology

- Legal and accounting: Professional advisors prevent expensive mistakes

Implementation Timeline: From Plan to Grand Opening

Months 1-2: Planning and Capital

- Finalize business plan and financial projections

- Secure financing (bank loans, SBA loans, investors, personal funds)

- Select legal entity and register business

- Initial market research and location scouting

Months 3-4: Location and Legal

- Negotiate lease terms and secure location

- Business entity formation and registration

- State license applications

- Insurance policy procurement

Months 5-6: Build-Out and Setup

- Construction and leasehold improvements

- Equipment ordering and delivery

- Technology infrastructure installation

- Signage and branding

Months 7-8: Operational Preparation

- Practice management software implementation and training

- Staff hiring and training

- Inventory purchasing (frames, lenses, supplies)

- Insurance credentialing applications

Month 9: Marketing Launch

- Website launch and local SEO

- Google Business Profile optimization

- Local advertising campaign

- Community outreach and partnerships

Month 10: Soft Opening

- Friends and family appointments

- Testing workflows and systems

- Staff training with real patients

- Process refinement

Months 11-12: Grand Opening

- Grand opening event and promotion

- Full marketing push

- Standard operating hours

- Revenue tracking and optimization

Total timeline: 10-12 months from business plan to grand opening

Some compress this to 6-8 months. Others take 15-18 months. Rushing increases mistakes; overthinking delays revenue. Find your balance.

Frequently Asked Questions

Q: How much money do I need to start an optometry practice?

A: Plan for $200,000 to $500,000+ in total startup capital. This includes $100,000-$250,000 for equipment, $50,000-$150,000 for build-out, $20,000-$50,000 for optical inventory, $10,000-$30,000 for technology, and $30,000-$100,000 in working capital. The exact amount depends on location, practice size, service scope, and whether you’re buying new or used equipment.

Q: How long until my practice becomes profitable?

A: Most practices reach break-even at 9-24 months depending on focus and market. Specialty contact lens practices may hit break-even at 9-12 months. General optometry practices with optical typically reach break-even at 12-18 months. Full-service medical optometry may take 18-24 months. Consistent profitability usually follows 3-6 months after break-even.

Q: What profit margins should I expect?

A: Small independent clinics typically achieve 10-20% net profit margins. Practices with optical shops and ancillary services can reach 25-30% net margins. Established, efficiently-run practices achieve 28-40% margins. Your actual margins depend on operational efficiency, staff management, location overhead, service mix, and expense control.

Q: Do I need an in-house optical dispensary?

A: Not legally required, but highly recommended. Optical sales carry 50-70% gross margins and can represent 50-60% of total revenue. Without optical, you leave this revenue on the table. The startup investment is $40,000-$80,000 for inventory, displays, and finishing equipment, but pays back within the first year for most practices.

Q: What insurance plans should I accept?

A: Selectively credential with 3-5 vision plans that have strong market penetration and acceptable reimbursement (typically VSP, EyeMed, Spectera, Avesis). Also credential with major medical carriers (Medicare, Blue Cross/Blue Shield, UnitedHealthcare, Aetna, Cigna) to bill medical exams and disease management. Avoid panels with reimbursement below your cost unless they bring significant volume.

Q: How do I determine the right location?

A: Analyze demographics within 5-10 mile radius: populations of 20,000-50,000, optometrist-to-population ratios of 1:7,000 or better, growing or aging populations (55+), median household incomes above $50,000, and strong vision insurance penetration. Evaluate visibility, parking, proximity to complementary businesses, and accessibility. Higher rent in prime locations often generates significantly more revenue than savings from cheaper marginal locations.

Q: How much should I spend on marketing?

A: Industry benchmark is 5-10% of revenue. For a startup targeting $500,000 annually, budget $25,000-$50,000 (roughly $2,100-$4,200 monthly). This covers website, SEO, Google Ads, social media, direct mail, community sponsorships, and print materials. Track ROI by channel—keep what works, cut what doesn’t. In early months with low revenue, you may spend a higher percentage to build initial patient base.

Q: What technology systems are essential?

A: You need an integrated practice management and EHR system that handles scheduling, electronic health records, insurance verification and billing, inventory tracking, patient communication, and financial reporting. Budget $10,000-$30,000 initially plus $500-$1,500 monthly. Don’t cobble together separate systems—integrated platforms save administrative time, reduce billing errors, and provide better patient experience.

English

English  Polski

Polski  Čeština

Čeština  Deutsch

Deutsch  Español

Español  Français

Français  Ελληνικά

Ελληνικά  Hrvatski

Hrvatski  Italiano

Italiano  Lietuviškai

Lietuviškai  Magyar

Magyar  Nederlands

Nederlands  Português

Português  Română

Română  Slovenčina

Slovenčina  Svenska

Svenska  Türkçe

Türkçe  Русский

Русский