Revenue Cycle Management in Optometry: Stop Leaving 20% of Your Revenue on the Table

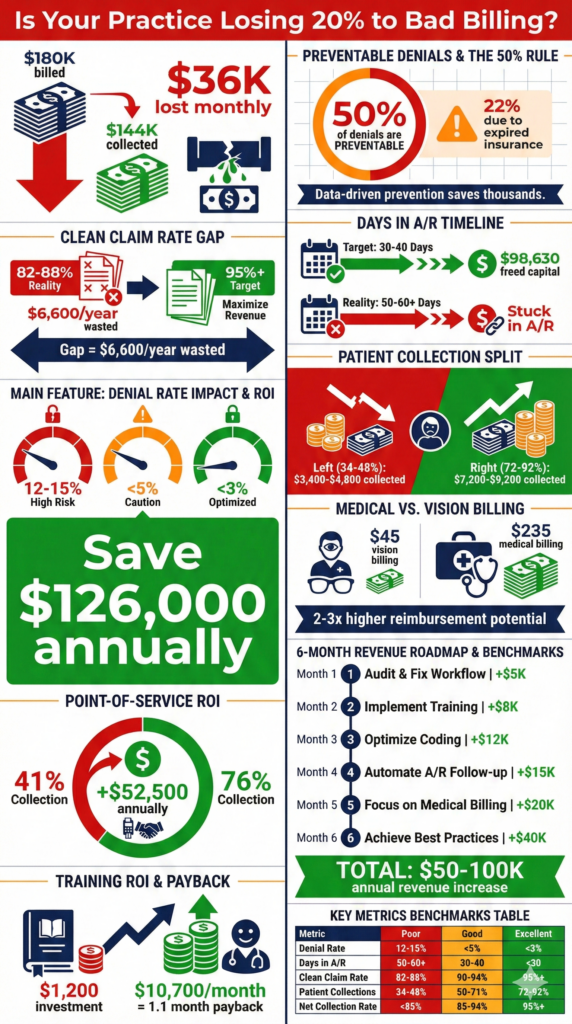

Your optical POS shows $180,000 in production this month. Congratulations—except you’ll probably only collect $144,000 of that.

The missing $36,000? It’s sitting in claims that got denied for “missing information,” patient balances that nobody’s collecting, and authorizations that expired three days before the appointment. Month after month, practices lose up to 20% of their potential revenue to these entirely fixable problems.

Revenue Cycle Management sounds like corporate jargon, but here’s what it actually means: the difference between what you bill and what you actually get paid. For most optometry practices, that gap is embarrassingly wide—and completely unnecessary.

Key Insights

- 50% of all claims denials are preventable front-end errors—before the patient even sits in your chair

- Clean claim rate should be 95%+, yet most practices hover around 85% (10% revenue loss from rework)

- Days in A/R target: 30-40 days for optometry (many practices run 50-60+ days)

- Average denial rate: 12-15%, but best-in-class practices maintain under 3%

- Patient collection rates: 34-48% typical, but digital point-of-service collection achieves 72-92%

- Eligibility verification failures alone cause 22% of all preventable denials

- Cost to collect should be ≤2-4% of revenue—automation reduces this significantly

- First Pass Yield benchmark: 90%+ (claims paid on first submission without edits)

What Revenue Cycle Management Actually Means

RCM isn’t just billing. It’s every step from when a patient books an appointment until you receive final payment. That includes:

Before the appointment: Insurance verification, eligibility checks, prior authorization, patient responsibility estimates, appointment scheduling with complete demographic capture.

During the visit: Accurate documentation, proper coding, charge capture, point-of-service collection, clear communication about what patient owes.

After the visit: Claims submission, denial management, payment posting, patient statement generation, collections follow-up, accounts receivable aging analysis.

Most practices excel at the clinical side but struggle with everything that happens before and after. That’s where the money disappears.

The 50% Rule: Half Your Denials Are Completely Preventable

Here’s a stat that should make you angry: 50% of all claims denials happen because of front-end errors—problems that occur during scheduling and registration, before you ever perform an exam.

The biggest culprits:

Expired insurance coverage (22% of denials). Patient shows up with last year’s card. Your front desk enters the information. Claim gets denied six weeks later. Now you’re chasing the patient for payment they thought was covered.

Missing or incorrect demographic information. Name spelled “Jon” in your system but “John” with insurance. Date of birth off by one digit. Address doesn’t match insurance records. All automatic denials.

Wrong policy numbers. Patient gives you their member ID when you need the policy number, or vice versa. Sometimes insurance cards don’t clearly indicate which number is which.

No prior authorization. Some insurance requires authorization for specialized testing (visual fields, OCT, corneal topography). Without it, automatic denial—even if the service was medically necessary.

One practice tracked their denials for three months:

- Total denials: 147 claims

- Preventable front-end errors: 73 claims (49.7%)

- Average claim value: $185

- Lost revenue from preventable errors: $13,505 in just one quarter

They implemented systematic patient data verification and real-time eligibility checking. Three months later, their front-end error rate dropped from 50% to 18%. That’s $8,650 recovered every quarter—$34,600 annually—just from better registration.

7-day free trial

Got Any Questions? Let us know in the Contact Us form below.

Clean Claim Rate: Your Most Important Number

Your Clean Claim Rate (CCR) measures the percentage of claims submitted without errors that pass through without manual intervention. Target: 95% or higher. Reality for most practices: 82-88%.

Why does this matter? Because every claim that isn’t clean requires someone to:

- Review the denial reason

- Pull the patient chart

- Figure out what went wrong

- Correct the information

- Resubmit the claim

- Follow up again

Time per claim correction: 15-30 minutes. If you’re submitting 500 claims monthly at 85% CCR, that’s 75 claims needing correction. At 20 minutes average, that’s 25 hours monthly just fixing preventable errors.

At $22/hour for billing staff, that’s $550 monthly or $6,600 annually in direct rework costs. And that doesn’t count the delayed revenue or cash flow impact.

How to improve your CCR:

Verify insurance before every appointment. Not when they check in—three days before. This gives you time to resolve issues before the patient shows up. Automated appointment reminders can trigger verification workflows.

Use real-time eligibility checking. Modern practice management systems verify coverage in seconds, showing active benefits, copays, deductibles, and authorization requirements. No more “we’ll check and get back to you.”

Standardize data entry. Create protocols: always middle initial, always city in all caps, always spell out “Street” not “St.” Consistency prevents mismatches with insurance databases.

Double-check modifiers. RT/LT for right/left eye, modifier 25 when performing both an exam and procedure same day. Missing or incorrect modifiers cause instant denials.

<expert_voice> “The practices that master revenue cycle management don’t have better clinical skills or fancier equipment. They have better systems. They verify insurance automatically three days before appointments. They catch errors before claims go out, not six weeks later. They collect patient responsibility at checkout, not via statements nobody pays. Small process improvements compound into massive financial impact.”

— Adam Smith, Product Manager @ Glasson </expert_voice>

Days in A/R: How Fast Money Moves (Or Doesn’t)

Days Sales Outstanding (DSO)—also called Days in A/R—measures how long it takes from patient visit to cash in your account.

Formula: (Average Accounts Receivable ÷ Net Revenue) × 365 days

Target for optometry: 30-40 days. Medicare pays in 14 days minimum under prompt-pay laws. Commercial insurance should pay within 30 days. If your DSO is 50+ days, money is stuck somewhere.

Common bottlenecks:

Slow claim submission. Some practices batch claims weekly or even monthly. That’s 7-30 days of automatic delay. Submit daily or—better yet—automatically at end of each day.

Denial rework delays. Denied claims sit in a queue waiting for someone to address them. That queue becomes a black hole where revenue goes to die. Prioritize immediate denial review within 24-48 hours.

Patient balance follow-up. Practices wait 30 days after insurance pays to send the patient statement. Then 30 more days before follow-up. That’s 60+ days before any collection effort. Automated patient statements go out immediately when insurance processes.

One practice reduced DSO from 58 days to 34 days by implementing three changes:

- Daily automated claim submission (saved 3-7 days)

- Same-day denial review protocol (saved 10-15 days)

- Immediate patient statement generation (saved 8-12 days)

Financial impact: With $150,000 monthly revenue, reducing DSO by 24 days improved cash flow by approximately $98,630 in freed-up working capital. That’s money available now instead of sitting in receivables.

The Denial Rate Challenge

Industry average denial rate: 12-15%. Your target: under 5%. Best-in-class: under 3%.

Every percentage point improvement equals significant revenue. At $150,000 monthly production:

- 12% denial rate = $18,000 in denied claims monthly

- 5% denial rate = $7,500 in denied claims monthly

- Difference: $10,500 monthly or $126,000 annually

Even if you successfully appeal 60% of denials, that’s still tens of thousands lost plus all the administrative costs of appeals.

Denial prevention strategies:

Create a “pre-flight checklist” for every claim. Before submission, verify: patient demographics match insurance exactly, CPT codes are accurate and not bundled incorrectly, diagnosis codes support medical necessity, modifiers are present and correct, authorization number is included if required.

Analyze denial patterns monthly. If “missing authorization” appears 40 times, your authorization tracking process is broken. If one insurance company generates 70% of denials, something about your process doesn’t match their requirements.

Assign denial ownership. Someone should own the entire denial workflow: immediate review, categorization by cause, correction and resubmission, tracking appeal success rates, trend analysis, and process improvements.

Build reporting dashboards that surface denial patterns automatically rather than requiring someone to compile spreadsheets manually.

Patient Collections: The Growing Problem

Here’s an uncomfortable truth: patient responsibility now represents 30-50% of practice revenue in many cases. Between high-deductible plans, copays, and uncovered services like basic optical, your patients owe a lot.

Collection rates tell the story:

- Industry average for patient responsibility: 34-48%

- With digital point-of-service collection: 72-92%

That means typical practices collect only $3,400-$4,800 of every $10,000 in patient balances. The other $5,200-$6,600 evaporates.

Why collection rates are so low:

Statement fatigue. Patients receive bills from everyone—doctors, hospitals, labs, specialists. Your statement gets lost in the pile. By the time you follow up, they’ve forgotten the visit or are angry about unexpected costs.

Confusing bills. Statements filled with CPT codes (92014, 92015), unclear balances, and cryptic insurance adjustments invite patients to ignore them.

No urgency. Unlike retail purchases where you pay immediately, medical billing creates artificial separation between service and payment. Months pass. Urgency fades.

The point-of-service collection solution:

Collect patient responsibility before they leave your office. This requires:

Upfront cost estimation. Tell patients what they’ll owe before services are rendered. “Your insurance covers 80% after deductible. Based on services today, your portion will be approximately $65.”

Multiple payment options. Credit/debit cards, mobile payments, payment plans, online portal access. Make it easy to pay right now.

Financial policy clarity. “We collect copays and patient portions at time of service. Would you like to pay by card or set up a payment plan?”

Friendly, consultative approach. Not “You owe $65,” but “I wanted to review your coverage. Your insurance will cover most of this, and your portion today is $65. How would you like to handle that—card, check, or I can set up a payment plan?”

One practice implemented point-of-service collection protocols with integrated payment processing:

- Before: 41% patient collection rate ($61,500 collected of $150,000 owed)

- After: 76% patient collection rate ($114,000 collected of $150,000 owed)

- Additional revenue recovered: $52,500 annually

Want to see Glasson's full potential?

Book a presentation

The Coordination of Benefits Advantage

Optometry sits at the intersection of medical and vision insurance—a complexity but also an opportunity.

Medical insurance covers medically necessary eye exams (diabetic retinopathy, glaucoma, macular degeneration, etc.) and often reimburses at higher rates.

Vision insurance covers routine refractive exams, eyewear, and contact lenses, usually with lower reimbursement.

Many patients have both. Proper coordination of benefits can generate 2-3x higher reimbursement per patient.

Example scenario:

Patient presents for annual eye exam with family history of glaucoma:

Vision insurance only:

- Routine exam: $45 reimbursement

- Total: $45

Proper medical billing:

- Comprehensive exam (medical necessity): $95

- Visual field test: $65

- OCT imaging: $75

- Total: $235

The difference: $190 per patient. Multiply across hundreds of patients annually.

Requirements for medical billing:

- Medical necessity documentation (symptoms, risk factors, findings)

- Proper diagnosis coding (ICD-10)

- Clear distinction between routine vs. medical

- Comprehensive clinical documentation supporting code selection

Technology That Actually Helps

Manual RCM is a losing battle. Staff can’t check eligibility for 50 patients daily, track 500 claims monthly, follow up on 100 patient statements, and still have time for actual patient care.

What to look for in RCM technology:

Automated eligibility verification that checks coverage 3-5 days before appointments and flags issues requiring attention.

Real-time claim scrubbing that catches errors before submission—missing modifiers, bundling errors, diagnosis/procedure mismatches.

Integrated payment processing that makes point-of-service collection seamless, not a separate awkward transaction.

Denial tracking and categorization that automatically sorts denials by type and flags patterns requiring process changes.

Patient communication automation sending statements immediately when balances post, with clear payment instructions and multiple payment options.

Reporting dashboards providing real-time visibility into key metrics: clean claim rate, denial rate, days in A/R, collection rates, aging buckets.

Modern practice management platforms integrate these functions rather than requiring four different systems that don’t talk to each other.

Building Staff Competency

RCM requires specialized skills. Your front desk shouldn’t need to be coding experts, but someone on your team should deeply understand:

Insurance verification protocols: What to check, when to check it, how to document, when authorization is required.

Coding accuracy: CPT codes for common optometry services, when to use modifiers, ICD-10 coding for medical necessity, documentation requirements for each code level.

Denial management: How to read explanation of benefits (EOB), common denial codes, correction procedures, when to appeal vs. accept, tracking systems.

Patient collections: Financial policy communication, payment option presentation, difficult conversation scripts, payment plan setup.

Investment in training pays for itself:

One practice sent their billing specialist to a two-day optometry coding workshop ($800 + travel). She returned with insights that:

- Reduced their denial rate from 11% to 6% (worth $7,500 monthly)

- Identified $3,200 monthly in previously unbilled medical services

- Improved documentation protocols preventing compliance risk

ROI: $10,700 monthly improvement from $1,200 investment. That’s payback in 1.1 months, with benefits continuing indefinitely.

Your RCM Improvement Roadmap

Trying to fix everything at once guarantees nothing improves. Pick one area, measure baseline, implement changes, track results.

Start here (easiest, highest impact):

Month 1: Implement automated eligibility verification. Check every patient 3-5 days before appointments. Flag issues requiring follow-up.

Expected improvement: 5-8% reduction in denials from eligibility issues (worth $3,000-$5,000 monthly for typical practice).

Month 2: Establish point-of-service collection protocols. Estimate patient portions before they leave. Collect at time of service when possible.

Expected improvement: 15-20% increase in patient collection rate (worth $10,000-$15,000 annually).

Month 3: Create denial tracking and analysis system. Categorize every denial by type. Monthly review of patterns. Assign corrective actions.

Expected improvement: 2-4% reduction in overall denial rate (worth $3,000-$6,000 monthly).

Month 4: Implement daily claim submission. Stop batching. Submit claims at end of each day automatically.

Expected improvement: 5-10 day reduction in DSO, improving cash flow significantly.

Month 5: Audit coding accuracy. Review documentation for common services. Ensure proper code selection and modifier use.

Expected improvement: 3-5% increase in reimbursement from correct code utilization.

Month 6: Enhance patient statements. Clear language, prominent balance, multiple payment options, QR codes for online portal.

Expected improvement: 10-15% improvement in statement response rates.

Each improvement compounds. A practice implementing all six changes over six months typically sees:

- 12-18% reduction in denial rates

- 15-25 day improvement in DSO

- 20-35% increase in patient collection rates

- $50,000-$100,000 additional annual revenue for $500K-$1M practices

Test Glasson for 7 days free of charge

Any questions? Leave your contact details and we'll call you back.

Frequently Asked Questions

Q: What’s the single most important RCM metric to track?

A: Clean Claim Rate (CCR). If you’re submitting 95%+ error-free claims, most other metrics improve automatically. CCR reflects your entire front-end process: scheduling, registration, verification, documentation, and coding. Start here—everything flows from submission accuracy.

Q: How often should we verify insurance eligibility?

A: For every appointment, 3-5 days in advance. This gives time to resolve issues before the patient arrives. Insurance changes happen constantly—new jobs, open enrollment, policy cancellations. Yesterday’s active coverage may be expired today.

Q: Should we collect patient portions before or after insurance processes?

A: Collect copays and known patient responsibility at time of service. For services requiring insurance processing (deductibles, coinsurance), provide estimates at checkout and collect balances immediately when insurance processes. The longer you wait, the lower your collection rate.

Q: What denial rate should we target?

A: Under 5% for acceptable performance, under 3% for best-in-class. Industry average is 12-15%, which means most practices are leaving significant money on the table. Every percentage point improvement directly impacts revenue.

Q: How long should accounts receivable sit before we write them off?

A: Follow aggressive timelines: 30 days from service (first statement), 60 days (second statement + phone call), 90 days (final notice), 120 days (collections agency or write-off). The older a balance gets, the less likely you’ll collect. Don’t let money age unnecessarily.

Q: Should we outsource RCM or keep it in-house?

A: Depends on practice size and expertise. Practices under $500K annual revenue often benefit from outsourcing (cost: 4-8% of collections). Larger practices with dedicated billing staff can maintain in-house operations at 2-4% cost. Hybrid approaches work too—outsource denials and appeals while maintaining core billing in-house.

Q: How do we handle high patient balances that people can’t pay?

A: Offer payment plans immediately (e.g., $200 balance = $50 monthly for 4 months). Use automated payment processing to set up recurring charges. Be flexible but consistent. Patients willing to pay something are better than writing off the entire balance.

Q: What’s the best way to reduce days in accounts receivable?

A: Three steps: (1) Submit claims daily, not weekly or monthly, (2) Review and address denials within 24-48 hours—don’t let them sit in queues, (3) Send patient statements immediately when insurance processes, not 30 days later. These three changes typically reduce DSO by 15-25 days.

Q: How can we tell if our RCM processes need improvement?

A: Compare your metrics to benchmarks: Clean claim rate under 90%? Days in A/R over 45? Denial rate over 8%? Patient collection rate under 50%? Any of these indicate significant improvement opportunities worth tens of thousands annually.

Q: Is RCM software worth the investment for a solo practitioner?A: Absolutely. Even solo practices process hundreds of claims monthly. Manual processes waste hours weekly and guarantee errors. Modern RCM technology pays for itself through: faster reimbursement, fewer denials, higher collection rates, and freed staff time. The ROI typically pays back in 3-6 months.

English

English  Polski

Polski  Čeština

Čeština  Deutsch

Deutsch  Español

Español  Français

Français  Ελληνικά

Ελληνικά  Hrvatski

Hrvatski  Italiano

Italiano  Lietuviškai

Lietuviškai  Magyar

Magyar  Nederlands

Nederlands  Português

Português  Română

Română  Slovenčina

Slovenčina  Svenska

Svenska  Türkçe

Türkçe  Русский

Русский